Publicado em

- 3 min read

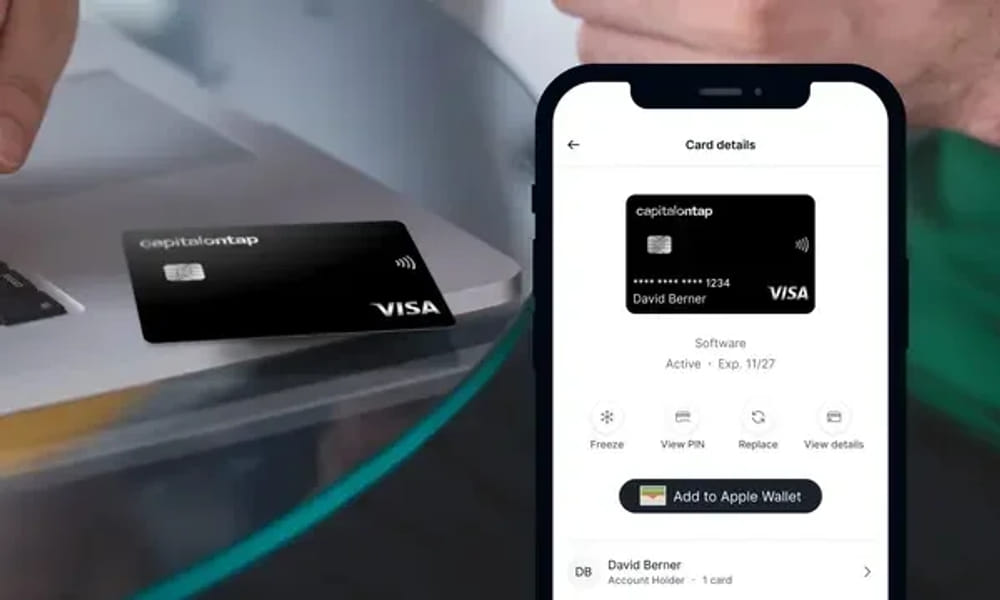

Capital On Tap Business Rewards Visa Credit Card: A Comprehensive Review

In the world of credit cards and rewards programs, the Capital On Tap Business Rewards Visa credit card has emerged as a unique offering that deserves attention. In this comprehensive review, we will delve into the key features, benefits, and application process of this card, shedding light on why it stands out in the market.

Who is Capital On Tap?

Capital On Tap, though not a household name, has already gained a substantial customer base of 120,000 individuals through its existing payment card offerings and Avios products. The Business Rewards Visa card, introduced in 2018, marked its entry into the rewards market, bringing a fresh perspective to the credit card landscape.

Key Features and Benefits

» Earn Avios Points:

The standout feature of the Capital On Tap Business Rewards Visa card is its ability to earn Avios points. For every £1 spent, cardholders earn 1 Capital On Tap point, which is equivalent to 1p cashback or 1 Avios point.

» No Foreign Exchange Fees:

Unlike many other credit cards, this card does not charge foreign exchange fees when used abroad, making it a great choice for international travelers.

» Flexible Interest Rates:

The card offers competitive interest rates, starting as low as 1.19% per month. The representative interest rate for marketing purposes is 34.3% APR variable.

» Exclusive Reader Offer:

Our readers can benefit from an exclusive sign-up bonus of 10,000 Capital On Tap points when they spend £5,000 within the first three months. This bonus translates to £100 cashback or 10,000 Avios points.

» Additional Benefits:

- Unlimited Free Supplementary Cards: Cardholders can issue supplementary cards for their staff at no extra cost.

- High Credit Limit: The card offers a generous credit limit of up to £250,000.

- Extended Payment Period: Up to 56 days to pay before incurring interest.

- Compatibility: The card is compatible with Apple Pay and Google Pay.

- Accounting Integrations: Seamless integrations with accounting software like Sage, QuickBooks, and Xero.

» Instant Avios Transfers:

Avios transfers from Capital On Tap are instantaneous, offering cardholders quick access to their rewards.

» Tax Deductible Annual Fee:

The annual fee of £99 is tax deductible for businesses, reducing the effective cost of the card.

Who Can Apply?

The Capital On Tap Business Rewards card is designed for limited companies and LLPs. It is not available for unlimited partnerships or sole traders. Applicants are required to have a minimum turnover of £24,000.

Why Choose the Capital On Tap Business Rewards Visa Credit Card?

For businesses that meet the eligibility criteria, the Capital On Tap Business Rewards Visa credit card presents a compelling proposition. The sign-up bonus, lack of foreign exchange fees, and the ability to earn Avios points make it a valuable tool for managing expenses and reaping rewards.

The tax deductibility of the annual fee further enhances its appeal. However, it’s important to note that Capital On Tap points can be converted into cashback as well, offering flexibility to cardholders based on their preferences and financial goals.

Summary

In summary, the Capital On Tap Business Rewards Visa credit card is a worthy consideration for businesses looking to optimize their spending and earn valuable rewards in the process. The unique combination of features and benefits makes it stand out in the competitive credit card market.

To learn more and apply, visit the Capital On Tap website. Please note that this review is provided for informational purposes, and individuals should assess whether the product aligns with their specific financial needs and circumstances.