Publicado em

- 7 min read

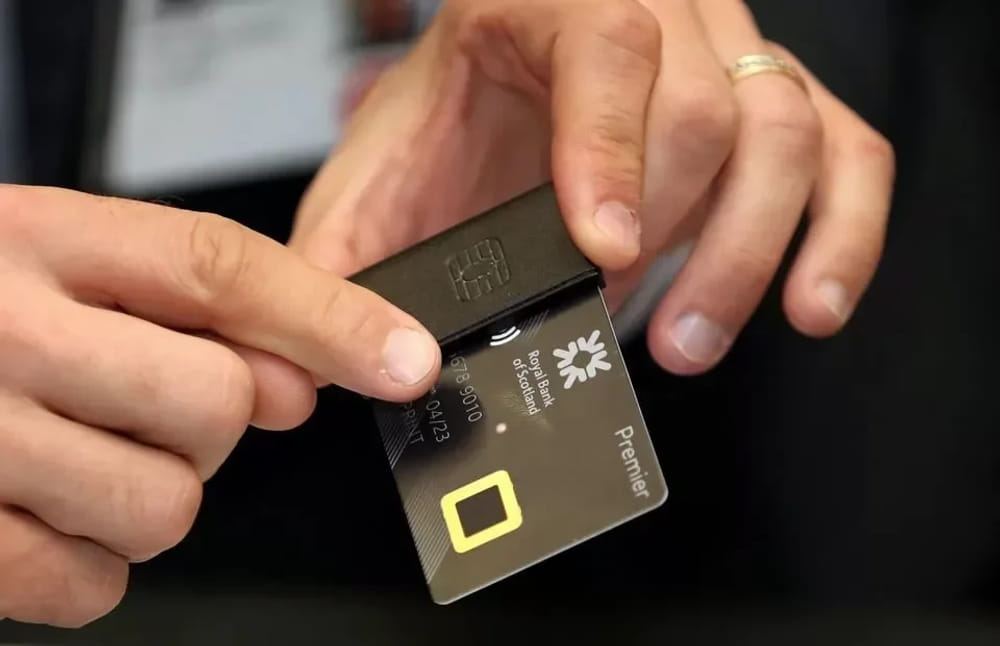

A Comprehensive Guide to the RBS Reward Black Credit Card

In today’s fast-paced world, managing finances efficiently is crucial, and choosing the right credit card plays a significant role in this endeavor. The RBS Reward Black Credit Card offers an impressive combination of luxury and practicality, designed to cater to individuals who seek both exclusivity and substantial financial rewards.

This guide delves into the comprehensive features, advantages, and potential drawbacks of the RBS Reward Black Credit Card, helping you make an informed decision.

Features of the RBS Reward Black Credit Card

The RBS Reward Black Credit Card opens the door to a world of exclusivity and financial benefits. With a Representative APR of 40.7% and an annual fee of £84, which is waived for Reward Black account holders, this card is particularly appealing. The card’s loyalty program stands out, providing 1% cashback at supermarkets and 0.5% on other purchases, including supermarket fuel stations.

» High Cashback Rates

Cardholders benefit from a generous cashback program, earning 1% on supermarket purchases and 0.5% on all other eligible transactions. This feature makes everyday spending more rewarding, allowing users to save significantly over time.

» Exclusive Rewards Program

The card’s loyalty program is designed to reward cardholders for their spending. Points are accumulated with every purchase, which can be redeemed for a variety of rewards, including discounts, exclusive offers, and more.

» Interest-Free Period

One of the standout features is the 56-day interest-free period on purchases. This benefit allows cardholders to manage their finances more effectively, avoiding interest charges if the balance is paid in full within this period.

» Global Usage Without Extra Charges

Travelers will appreciate the ability to use the card internationally without incurring additional currency conversion fees. This feature ensures that cardholders can spend freely while abroad, without worrying about extra charges.

» Favorable Balance Transfer Terms

The RBS Reward Black Credit Card offers favorable terms for balance transfers, allowing cardholders to consolidate debt from other cards or loans at a lower interest rate. This can be a strategic move to reduce overall interest payments and manage debt more effectively.

Benefits of the RBS Reward Black Credit Card

The benefits of the RBS Reward Black Credit Card extend beyond cashback and reward points, offering a suite of features that enhance the overall cardholder experience.

» Enhanced Savings on Daily Purchases

The cashback advantages on daily purchases, especially groceries, make this card a practical choice for everyday use. By earning cashback on regular expenses, cardholders can save a substantial amount over time.

» Flexible Reward Redemption Options

The points accumulated through the rewards program can be redeemed for a variety of options, including cashback, vouchers, goods, travel rewards, or even donations. This flexibility allows cardholders to choose rewards that best suit their preferences and lifestyle.

» Seamless International Usage

The absence of extra charges for international usage makes this card ideal for frequent travelers. Whether it’s for business or leisure, cardholders can use their card globally without worrying about currency conversion fees.

» Long Interest-Free Period

The 56-day interest-free period on purchases provides cardholders with ample time to manage their finances and avoid interest charges. This feature is particularly beneficial for those who prefer to pay off their balance in full each month.

» Lower Balance Transfer Rates

For those looking to consolidate debt, the favorable balance transfer terms offer a lower interest rate, making it easier to pay off existing debt and reduce overall interest payments.

Drawbacks of the RBS Reward Black Credit Card

While the RBS Reward Black Credit Card offers numerous benefits, it’s important to consider potential drawbacks to determine if it’s the right fit for you.

» Annual Fee

The card comes with an annual fee of £84, which might be a burden for those who do not fully utilize the card’s benefits. However, this fee is waived for Reward Black account holders, which could offset the cost for existing customers.

» Minimum Income Requirement

To qualify for the card, applicants must have an annual income of at least £15,000. This requirement may exclude lower-income individuals who might otherwise benefit from the card’s features.

» Credit Limitations

Applicants with low credit scores may face challenges in getting approved for the RBS Reward Black Credit Card. This limitation means that the card is better suited for individuals with a solid credit history.

Application Process for the RBS Reward Black Credit Card

Applying for the RBS Reward Black Credit Card is a straightforward process. By following these steps, potential cardholders can increase their chances of approval.

» Gather Necessary Documents

Before starting the application, gather all necessary documents such as identification, proof of address, and proof of income. Having these documents ready will streamline the application process.

» Begin the Application

Visit the RBS website or contact customer service to begin the application process. Provide personal, employment, and financial information as required.

» Credit Evaluation

Approval for the card depends on RBS’s credit evaluation and individual criteria. Ensure that your credit history and financial situation align with the card’s requirements to increase the likelihood of approval.

Rewards Program Overview

The rewards program associated with the RBS Reward Black Credit Card is one of its main attractions. Cardholders accumulate points on eligible purchases, which can be redeemed for a variety of rewards.

» Accumulating Points

Points are earned on every purchase, with higher rates for specific categories such as supermarket purchases. This makes it easy for cardholders to accumulate points quickly.

» Redeeming Points

The points can be redeemed for cashback, vouchers, goods, travel rewards, or even donations. This flexibility allows cardholders to choose rewards that match their preferences and lifestyle.

» Staying Updated

Cardholders should stay informed about bonus points, promotions, and any exclusions or limitations within the program. Keeping track of these updates ensures that you maximize your rewards.

Is the RBS Reward Black Credit Card Right for You?

Deciding whether the RBS Reward Black Credit Card is the right choice depends on individual spending habits and financial goals.

» Ideal for Frequent Travelers

The card’s lack of extra charges for international usage makes it an excellent choice for frequent travelers. If you travel often, this feature alone can save you a significant amount in fees.

» Suitable for High Spenders

With high cashback rates on everyday purchases, this card is ideal for individuals who spend a lot on groceries and other daily expenses. The more you spend, the more rewards you accumulate.

» Perfect for Existing RBS Account Holders

Existing RBS Reward Black account holders benefit from the waived annual fee, making the card even more attractive. This benefit adds value to those who already bank with RBS.

» Valuable for Reward Enthusiasts

If you value flexible reward redemption options, the RBS Reward Black Credit Card offers numerous ways to use your points. Whether it’s cashback, travel rewards, or vouchers, the choice is yours.

» Assessing Personal Preferences

Ultimately, assess your spending habits, potential rewards, and the annual fee against your personal preferences and financial goals. This evaluation will help you determine if the RBS Reward Black Credit Card is the right fit for you.

Conclusion

The RBS Reward Black Credit Card offers a compelling mix of luxury and practical financial benefits. With high cashback rates, an exclusive rewards program, and favorable terms for international usage and balance transfers, it stands out as a valuable choice for many consumers.

However, it’s essential to weigh the annual fee and minimum income requirement against your personal spending habits and financial goals. By doing so, you can determine if the RBS Reward Black Credit Card aligns with your needs and can enhance your financial management strategy.